Groww vs. Zerodha and how metrics are different between funded vs bootstrapped startups

What you measure is what you build.

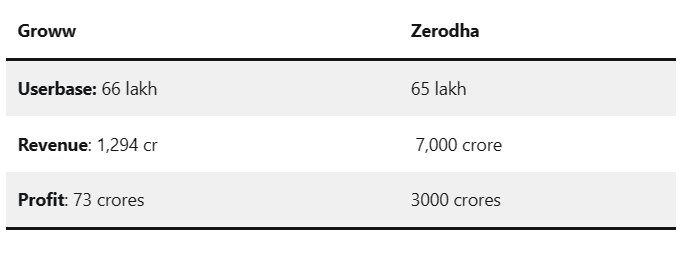

The startup media ecosystem is buzzing with the news that Groww has beaten Zerodha in terms of total active userbase.

Fair enough. Let’s revisit the numbers with some context.

Unlike Zerodha, Groww doesn’t charge for account opening / maintenance – and hence also attracts a lot of casual investors which also shows up in the revenue/customer number for the companies.

[Reproduced from nextbigwhat]

Startup metrics of Funded vs. Bootstrapped companies

This is a typical conundrum in the startup ecosystem – if you are well funded, you can absorb a lot of customer acquisition cost and also, show growth in metrics that may not be important (though, a lot of kudos and respect to Groww for building a profitable business and rise against a super strong incumbent).

When you are bootstrapped, you need to create value and most importantly, extract value – this ensures you have serious customer base, and which is why Zerodha ends up charging for even account opening/maintenance; while when you are funded – your metrics are to show growth – at any cost.

What’d be interesting to see if the casual investor of Groww start to convert into serious ones and start transacting on Groww (or Zerodha?).

And ofcourse, hoping that this battle grows the market.

What’s your take?